|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Discovering the Best Refinance Rates in San Diego for Your HomeRefinancing your home in San Diego can be a strategic move to lower your interest rate, reduce monthly payments, or cash out on your home equity. Understanding the current market and available options can help you make an informed decision. Factors Affecting Refinance RatesInterest rates are influenced by several factors, including the Federal Reserve's monetary policies, inflation trends, and the overall economic climate.

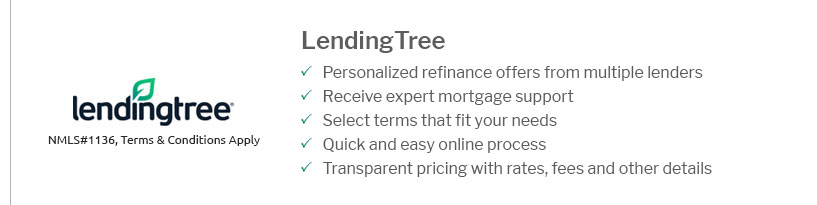

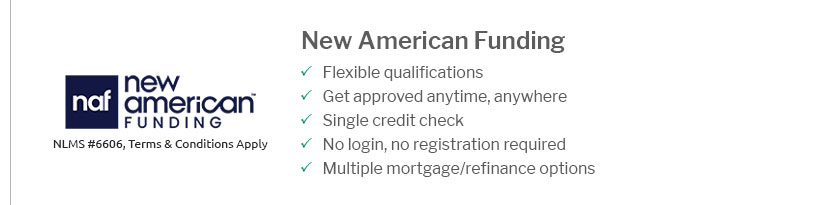

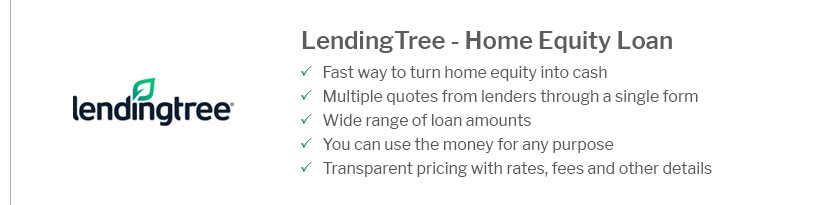

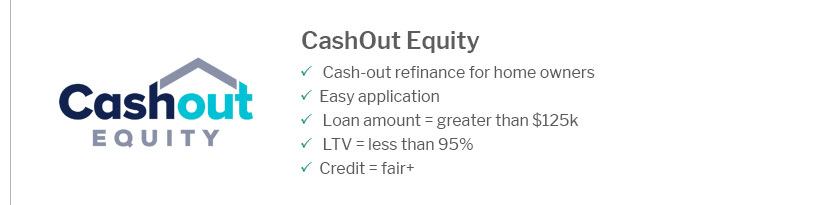

Top Lenders for Refinancing in San DiegoChoosing the right lender is crucial for obtaining the best home refinance with cash out options and rates. Here are some reputable lenders known for competitive rates and excellent service.

Evaluating LendersWhen evaluating lenders, consider factors such as customer service, fees, and the variety of refinance options they offer. Steps to Secure the Best Refinance RateSecuring a favorable refinance rate involves several steps, each requiring careful consideration and planning. Prepare Your FinancesImprove your credit score, pay down existing debts, and gather all necessary documentation to streamline the process. Shop AroundCompare offers from different lenders, including the best house refinance companies, to find the most competitive rate. FAQ SectionWhat is the average refinance rate in San Diego?As of 2025, the average refinance rate in San Diego is approximately 3.5%, but this can vary based on individual circumstances and market conditions. How can I qualify for the best refinance rates?To qualify for the best rates, ensure you have a high credit score, a low debt-to-income ratio, and substantial home equity. Additionally, shopping around and comparing offers is crucial. Is refinancing worth it in 2025?Refinancing can be worthwhile if it reduces your interest rate, lowers your monthly payments, or allows you to cash out equity. Consider your long-term financial goals and consult with a financial advisor. https://www.mypointcu.com/borrow/real-estate/real-estate-rates

Home Mortgage Rates ; 10 Year Fixed Rate - 5.750%. 5.806% ; 15 Year Fixed Rate - 5.875%. 5.915% ; 20 Year Fixed Rate - 6.000%. 6.032% ; 30 Year Fixed Rate - 6.500%. https://www.realtor.com/mortgage/rates/San-Diego_CA

Get the latest mortgage rates for purchase or refinance from reputable lenders at realtor.com. Simply enter your home location, property value and loan amount. https://www.trulia.com/refinance-rates/San_Diego,CA/

Don't settle for the first refinance rate you see. It pays to shop around for the best rates, so check rates from at least three lenders when you're looking to ...

|

|---|